Charitable Trusts - Unitrusts and Annuity Trusts

Uncover the Option that Matches Your Goal

Uncover the Option that Matches Your Goal

Which of the following would you like to accomplish?

- Boost your retirement income

- Provide for your heirs

- Reduce your taxes

- Support Marian Regional Medical Center

With charitable trusts, you can do all of the above. This guide offers helpful information on two popular types of charitable trusts. Keep reading to uncover which type may be right for you.

1. Charitable Remainder Trust: Receive Income for Life or a Term of Years

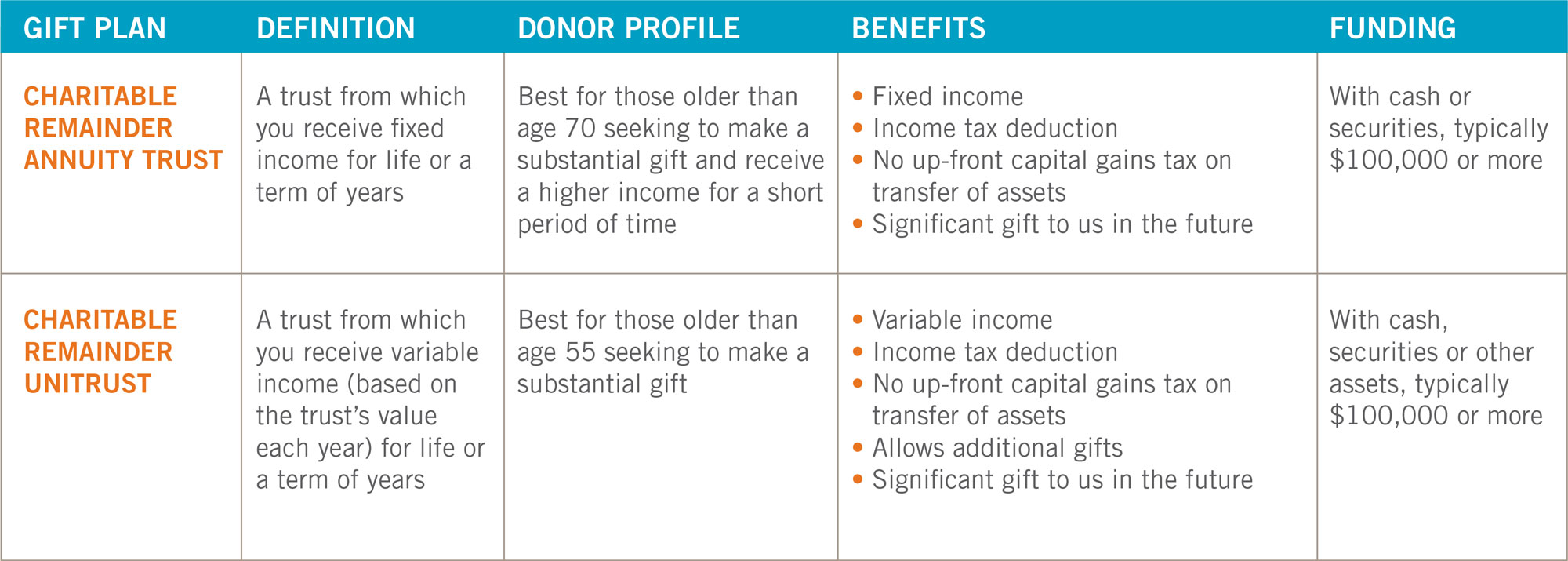

When you donate assets to a charitable remainder trust you create, you receive a stream of income from the trust, which can last for your lifetime or a set term of up to 20 years. The income amount may be greater than what the assets currently yield. If you wish, your spouse or another individual can receive an income from the trust after your lifetime. At the end of the trust term, the remaining balance goes to us. You can choose from two basic types of charitable remainder trusts. Use the chart below to help you determine which one fits your needs. Whatever your final estate’s value, you can use a portion of it to benefit Marian and rest easy knowing that your loved ones will also be taken care of. Even a small percentage can make a significant impact.

2. Charitable Lead Trust: Reduce Taxes and Leave an Inheritance for Your Heirs

With a charitable trust you transfer cash or assets, which are appreciating in value, into a trust you create with the intention of supporting Marian Regional Medical Center first and then returning the remaining assets to your family. It’s a tool that helps preserve family wealth.

The major benefit of creating a charitable lead trust is in transferring assets to family members at very little gift or estate tax costs. Using a lead trust, you could potentially pay a relatively small gift tax for eventually transferring a large amount of assets to your children. This type of gift provides you with a gift tax deduction, not an income tax deduction.

Types of Charitable Payments

Your transfer to the trust is treated as two separate gifts. The first gift is to us in the form of an annual payment. The second gift is the remainder interest that your family will ultimately receive. To receive a transfer tax deduction for the charitable payment, it must be either:

- An annuity payment: With this type of payment, we receive the same amount annually whether the trust assets appreciate or depreciate. If the trust income is insufficient, the trustee uses principal to make up the difference.

- A unitrust payment: With this option, we receive a variable amount based on a specified percentage of the fair market value of the trust assets, valued annually. You set the percentage upon creating the trust. The payments fluctuate with trust appreciation or depreciation. If the trust income is insufficient, the trustee uses principal to make up the difference.