Charitable Gift Annuities

A charitable gift annuity is a simple combination of two concepts: a charitable gift and income for life. Think of it as the gift that gives back. A gift annuity allows you to make a gift to the Marian program of your choice and benefit from the following:

A charitable gift annuity is a simple combination of two concepts: a charitable gift and income for life. Think of it as the gift that gives back. A gift annuity allows you to make a gift to the Marian program of your choice and benefit from the following:

- Safe, fixed income for your life and the life of a loved one (spouse or parent).

- Tax savings immediately and in the future

- Favorable treatment of capital gains, if funded with appreciated assets

- Membership in the Marian Legacy Society

How does a Charitable Gift Annuity work?

In exchange for an irrevocable gift of cash or publicly traded securities, Marian Regional Medical Center agrees to pay one or two persons a fixed annual income that is backed by the resources of the medical center. The charitable gift annuity rate of return is set by the American Council on Gift Annuities and is often higher than what is available from many conservative investments. The gift is set aside in a reserve account and invested. At the end of your life (and that of your loved one, should you choose an additional income beneficiary), Marian receives the remainder of the gift, which you may designate to a program of your choosing.

Are there any age or gift amount restrictions?

The minimum contribution to establish a gift annuity at Marian is $10,000. You may establish more than one annuity. There is no maximum gift amount. The minimum age is 60.

What assets can I use to fund a Charitable Gift Annuity?

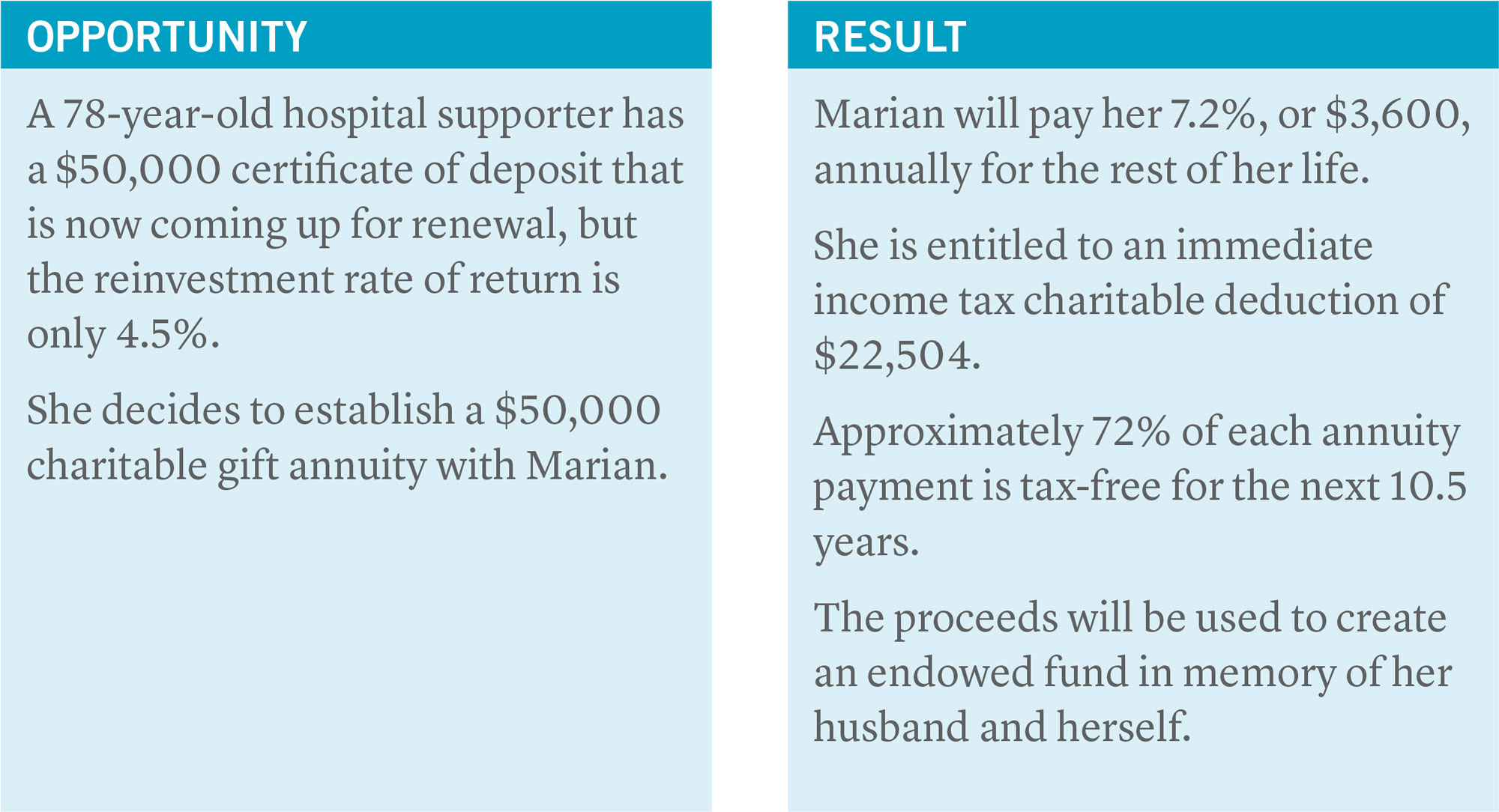

While cash is the most popular way to fund a gift annuity, you may also use the proceeds from maturing CDs or publicly traded stock.

Is it worth the time and energy to change from my current investment to a Charitable Gift Annuity?

Yes, especially if your current investment yields a variable rate of return. Because your income from a Marian charitable gift annuity will never decrease—nor can you outlive it—this one-time purchase can provide a stable annual income. This income can allow you to meet important needs, such as buying long-term care insurance or offsetting the costs of retirement facility care.

How is the annuity rate determined?

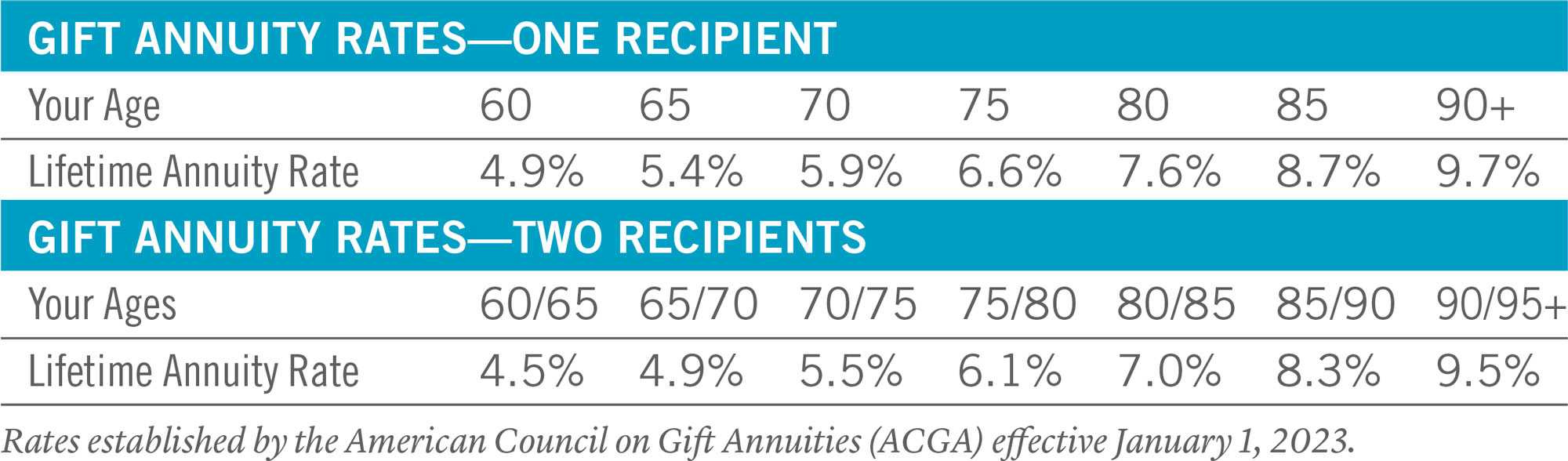

The annuity rate depends on the age of the annuitant(s) at the time of the gift. The older the annuitant(s), the more income Marian can agree to pay annually. The rate in effect when you establish the annuity never changes and is guaranteed for life. Charitable Gift Annuity Illustrations The following are sample gift annuity rates that Marian has offered recently.

Charitable Gift Annuity Illustrations

The following are sample gift annuity rates that Marian has offered recently.

Can I arrange for income in the future, such as when I retire?

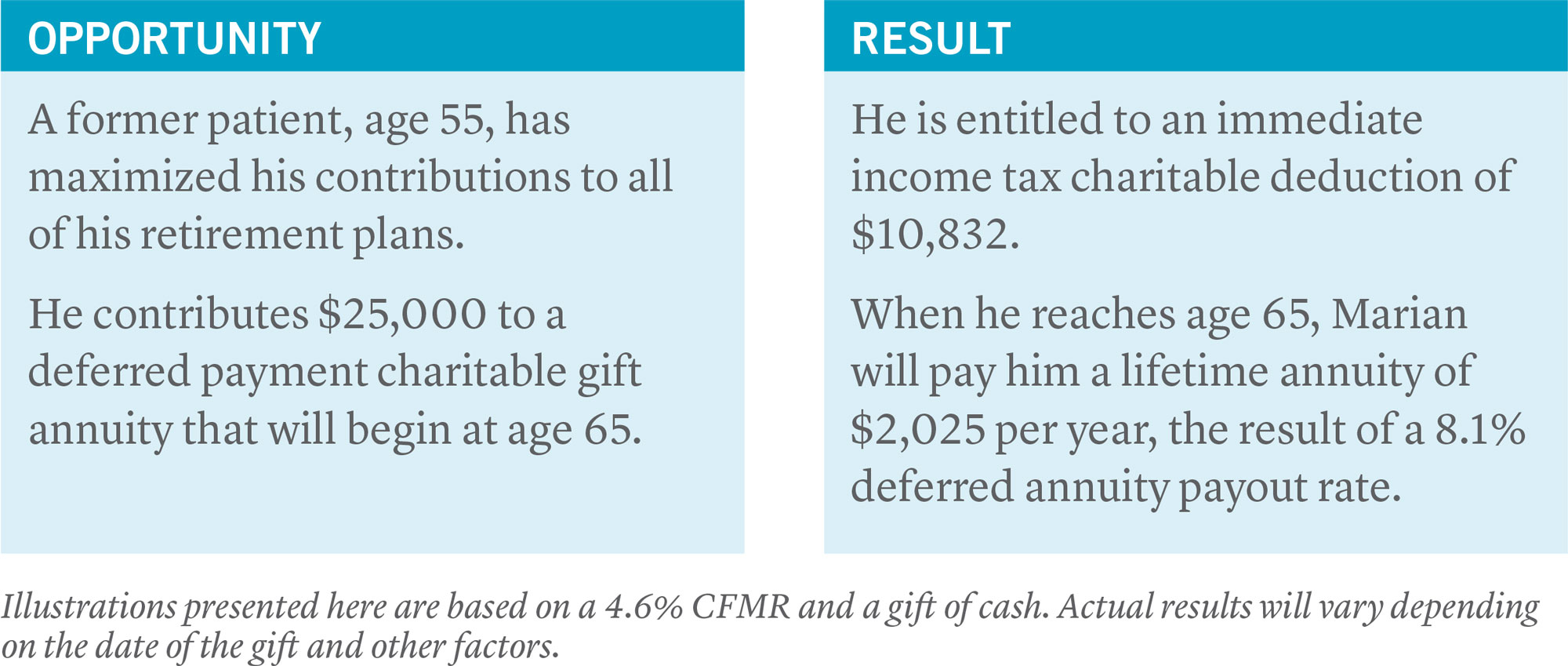

Many retirement arrangements such as IRAs, Keoghs, and 401(k) plans have contribution limits. If you are younger and wish to supplement your retirement plan, an alternative strategy is the deferred payment charitable gift annuity. This enables you to give cash or securities now and receive annuity payments at a later date, such as retirement. Deferring annuity payments yields higher payouts when payments begin and a significantly larger income tax deduction in the year the annuity is established. The minimum gift amount is $5,000 and the minimum age to establish a deferred gift annuity is 35, with the payments beginning at age 60 or older.

____________________________________

If you are tired of living at the mercy of the fluctuating stock and

real estate markets, make an investment that is

secure today—and in the future—by establishing a

charitable gift annuity with Marian.