Gifts of Stock Options

Stock options are a common form of employee compensation, and gifts of stock options are a cost-effective opportunity to transform this employee benefit into immediate and significant support.

A gift of stock options, like a gift of appreciated securities, is a worthwhile alternative to a cash gift. The elimination of employee benefit tax on gifts of stock options provides a substantial tax incentive for donating stock while benefiting Marian Regional Medical Center. Through a gift of stock options, you can help us our health care services both now and in the future.

The Advantage of Donating Stock Options

By donating stock options within 30 days after exercising in the same calendar year, donors receive a charitable tax receipt for the fair market value of the donation and eliminate the tax liability related to exercising the options.

Other benefits include:

- A charitable tax receipt

- Elimination of employee benefit taxes

- Satisfaction of seeing your gift put to good use today

- Recognition on the Donor Wall (cumulative lifetime giving $25,000+) and invitations to special Marian Foundation events throughout the year

Using a "Cash-Less Exercise"

A “cash-less” exercise is an alternative way to give stock options in which you don’t have to pay up front for the company stock when you exercise the option. This can be accomplished by instructing your employer’s broker to exercise your stock options and donate the profit.

If you exercise your stock options and donated the $50,000 in cash proceeds to Marian, the net cost of your gift would be reduced to $33,950. If you chose a cashless exercise of your stock options and donated in the same year and within 30 days after exercising, the net cost of your gift would be further reduced to $12,550.

Why is Donating Stock to Charity Better than Cash?

There are several great reasons to donate stock. To begin with, it’s one of the most tax-savvy ways to give. Plus, today’s online platforms make it an incredibly easy and secure process.

You can donate these types of securities to nonprofits:

- Publicly-traded stocks

- Privately-held stocks (which will require independent appraisals beforehand)

- Shares of mutual funds and ETFs

- Bonds

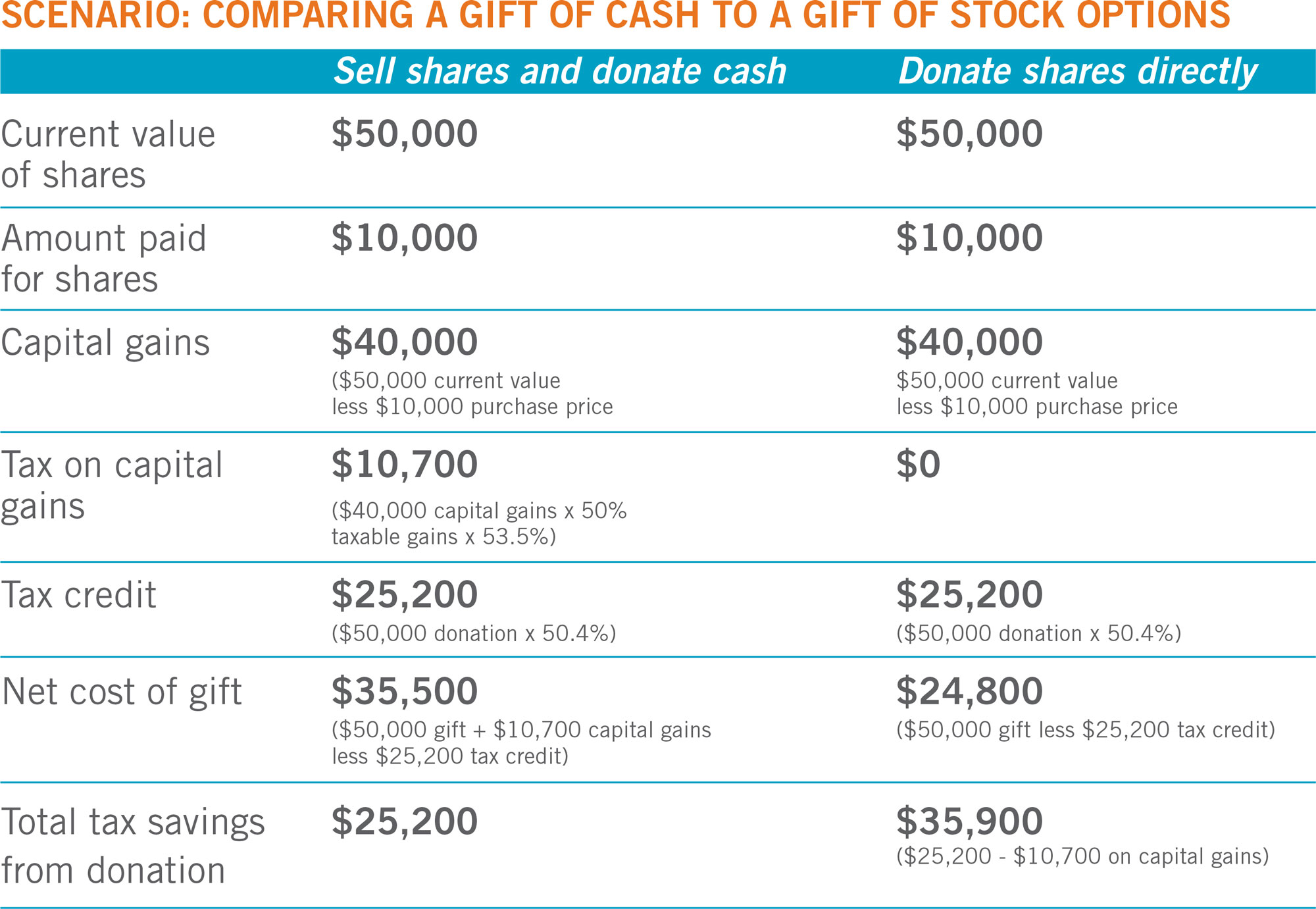

No matter which type of appreciated stock you donate, your gift goes further than if you sold it and donated the proceeds as cash. This is because donating appreciated stock lets you save on your taxes in two ways: you avoid capital gains tax on the appreciated value, and you can also claim a tax deduction on the value of the shares you donated.

Understanding the Tax Implications of Stock Donations

Let’s take a closer look at how the tax benefits of stock donations work.

A capital gains tax is the tax you have to pay on the profit generated when you sell a share of appreciated stock. Depending on your income bracket, you could be taxed up to 20% on your capital gains (for assets you’ve held for more than a year). However, if you donate this stock to a charity instead of selling it, neither you nor the charity have to pay taxes on it.

For example, let’s say you purchased a share of stock for $100, and it rose in value to $300 over two years. You’ve generated a capital gain of $200. When you sell that share, you’d have to pay a capital gains tax of up to $40, reducing the final value that you receive from the sale. But by directly donating the stock, the money you would have paid in taxes can instead go to the nonprofit, maximizing your philanthropic impact.

And like most charitable donations, stock donations are deductible from your income taxes. When you file your federal taxes, you can deduct the donation from your taxable income if you itemize your deductions. Some states give income tax deductions for stock as well.

Giving stock to nonprofits also exempts you from the wash-sale rule, which prohibits investors from selling and then immediately repurchasing stock from a company. When you donate stock, you can immediately repurchase the same stock at its fair market value, which will reset your shares at a higher cost basis and maintain the composition of your portfolio.

Donating stock is a win-win, both for you and for the causes that matter to you.